In the ever-evolving landscape of cryptocurrencies, Monero stands out as a beacon of privacy and decentralization, making it an intriguing option for savvy investors eyeing the Nordic regions of Scandinavia. With its advanced cryptographic features, Monero offers a shield against prying eyes, unlike the more transparent Bitcoin or Ethereum networks. As the demand for secure digital assets surges, investing in Monero mining rigs and hosting services in countries like Sweden, Norway, and Finland presents a strategic move. These nations boast abundant renewable energy sources and cool climates, ideal for efficient mining operations that minimize costs and environmental impact. Yet, the path to profitable investment requires careful navigation through technical nuances and market volatilities, blending innovation with prudence to yield substantial returns.

Monero, often abbreviated as XMR, utilizes the RandomX hashing algorithm, which democratizes mining by favoring CPU-based rigs over the energy-intensive ASICs dominating Bitcoin mining. This shift not only levels the playing field but also underscores the importance of selecting the right mining hardware. In Scandinavia, where technological infrastructure is world-class, investors can leverage high-speed internet and stable power grids to optimize their setups. Imagine transforming a modest investment into a thriving operation, where the hum of mining rigs echoes the pulse of innovation. However, the allure of Monero must be weighed against competitors like Dogecoin, which rides waves of community hype, or Ethereum, with its shift to proof-of-stake reducing energy demands. Each currency brings unique risks and rewards, demanding a diversified approach to mitigate potential losses in this unpredictable arena.

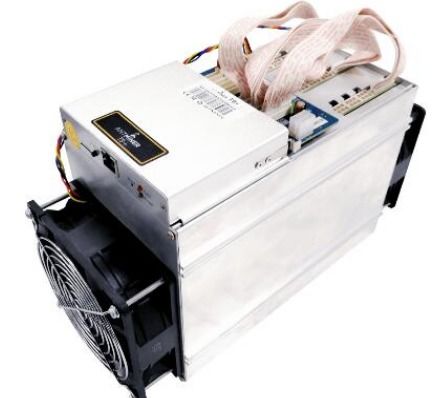

Transitioning to the hardware side, a mining rig for Monero typically involves powerful CPUs, ample RAM, and efficient cooling systems—elements that shine in Scandinavia’s chilly environment. Unlike the massive mining farms dedicated to Bitcoin, where rows of ASICs consume vast amounts of electricity, Monero rigs offer a more accessible entry point for individual investors.

This comparison reveals how Bitcoin’s dominance in energy use contrasts sharply with Monero’s eco-friendly profile, appealing to those conscious of sustainability. Yet, the investment isn’t just about buying equipment; it’s about understanding the lifecycle, from procurement to maintenance, ensuring your rig remains competitive amid fluctuating hash rates and network difficulties.

Hosting services add another layer of smart investing, particularly in Scandinavia, where specialized facilities manage the intricacies of operation. These services handle everything from hardware maintenance to security protocols, allowing investors to focus on strategy rather than daily grind. For instance, a hosting provider in Finland might offer state-of-the-art data centers powered by hydroelectric energy, slashing operational costs and enhancing profitability. This is where the concept of a mining farm comes into play—a centralized hub of miners working in unison, much like a symphony of technology. By outsourcing to such experts, you’re not merely renting space; you’re partnering in a venture that could yield passive income streams, especially when Monero’s price rallies due to privacy scandals or regulatory shifts.

Delving deeper, the choice between building your own mining rig or opting for pre-configured models depends on your expertise and budget. A basic Monero miner might start with off-the-shelf components, but for serious players, custom rigs tailored for RandomX provide an edge. In regions like Norway, with its forward-thinking policies on crypto, investors can access incentives that make hosting more attractive.

This setup exemplifies the blend of hardware and location, where the rig’s efficiency meets the host’s reliability to create a formidable investment vehicle. Meanwhile, exchanges play a pivotal role, enabling seamless conversion of mined Monero to fiat or other assets like ETH, adding fluidity to your portfolio.

As we wrap up, the smart ways to invest in Monero mining rigs and hosting in Scandinavia hinge on education, diversification, and timing. Whether you’re drawn to the privacy of Monero or the stability of Bitcoin, remember that the crypto world thrives on adaptability. By integrating renewable energy sources and cutting-edge technology, investors can not only profit but also contribute to a greener future. So, seize the opportunity, weigh the odds, and step into this dynamic realm where innovation meets investment, potentially unlocking doors to financial independence.

One Response

Scandinavia: Monero mining haven! Explore savvy strategies for rigs and hosting. Think green energy, cool climates, and potentially profitable crypto opportunities. Proceed with caution!